Whole Life Insurance is a type of insurance that guarantees a person will receive a fixed income for the rest of their life. This type of insurance is usually less expensive than other types of insurance, and it may be a good option for people who are not sure if they want to buy the best whole life insurance policy quotes online for free. They are eligible for insurance.

Image source: Google

If you are thinking about purchasing whole life insurance, there are a few things you should keep in mind.

Here are the tips to help you choose the best policy for your needs:

1. Consider Your Needs

The first step is to determine what your needs are. Do you want term insurance or permanent insurance? What kind of coverage do you need?

2. Get Quotes from Different Providers

Next, you should get quotes from different providers. Ask them about their whole life policies, how much they will cost, and how they work. You should also ask about the benefits and exclusions of each policy.

3. Consider Your Age and Health

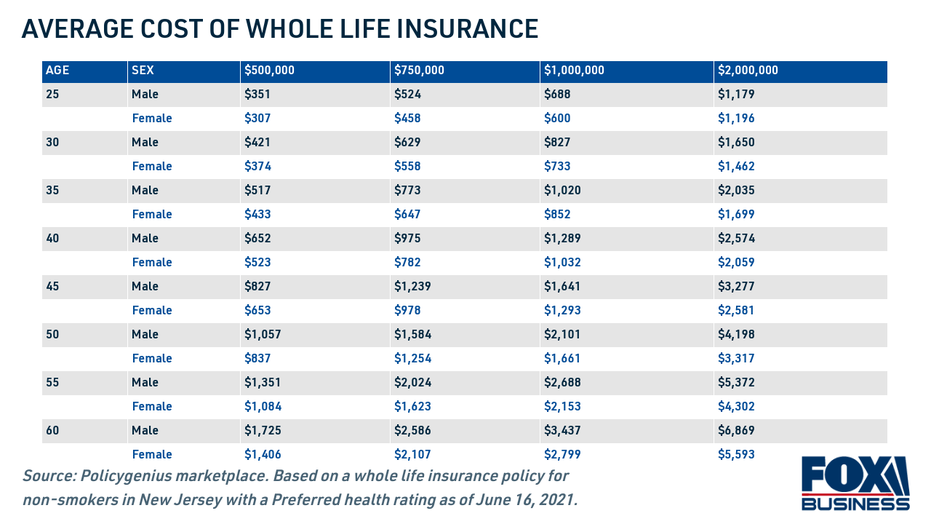

Age is an important factor when it comes to whole-life insurance. Younger people tend to be more risk-tolerant and are therefore likely to be better candidates for term insurance. However, as people get older, they may become more sensitive to financial risks and may want permanent coverage.

4. Compare Policy Terms and Conditions

Another important factor to consider is the terms and conditions of the policy. Make sure that the policy has a low surrender fee, high death benefit, and low premiums.