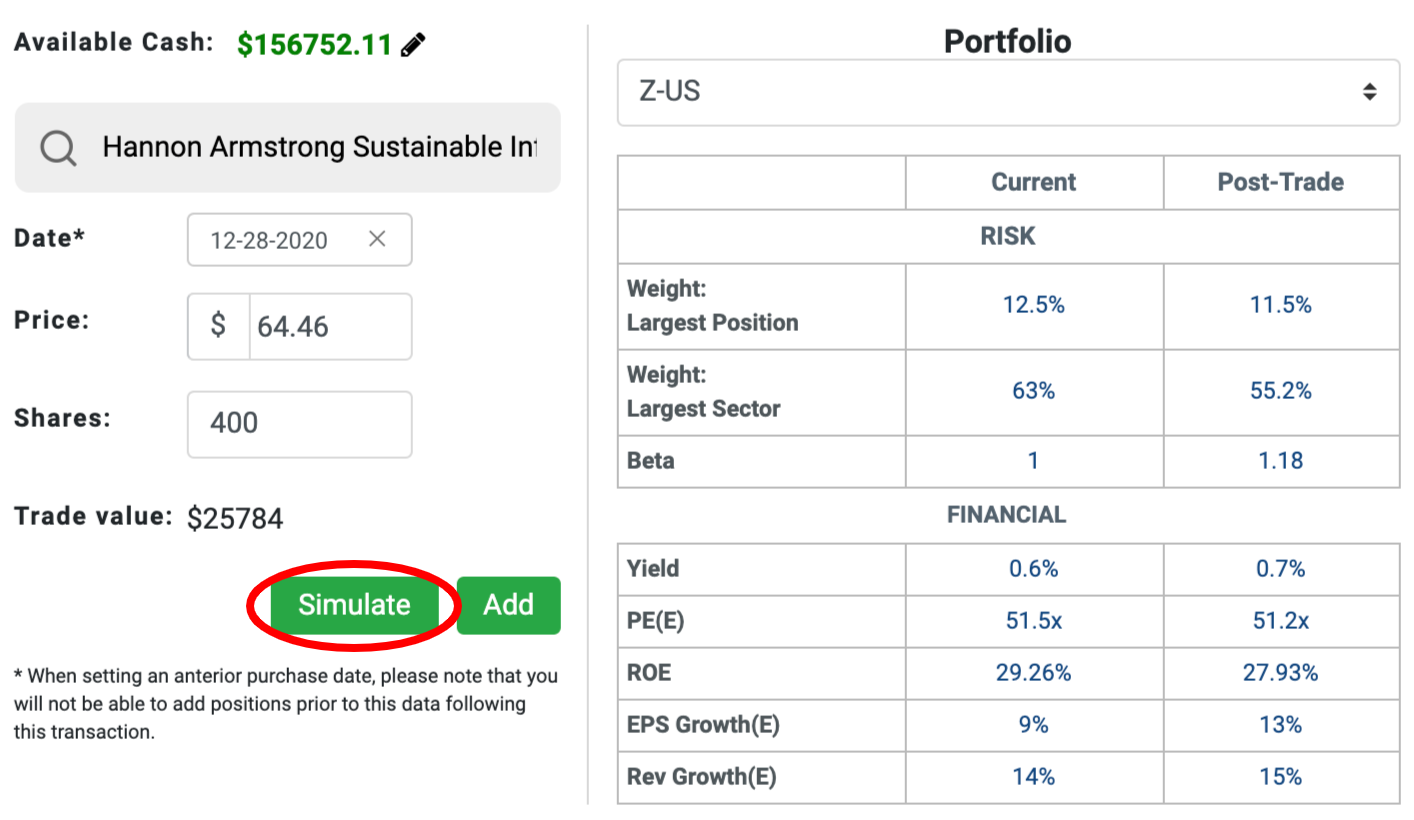

When choosing an investment management company to handle your assets, you must investigate the first few. Find out what their strategies are. Do they believe in buying established company shares at high costs and increased replacement of returns are slow but sure. Or whether they prefer to invest in stock new companies that are low in investment, risky, but can promise high refunds quickly. You can find investment portfolio simulator via https://ziggma.com/portfolio-simulation/.

Do they do all research at home. Or do they outsource their information. Do they have clean safety factors. What has proven the previous track record. Find out about their success and even the reason for their failure, if any. Whether one person in the team, or only one fund manager handles everything. Or is it a team with a fund manager at the top of the hierarchy. What is the turn of the employee. How the team operates together, etc. With this information you can measure how well your investment will be managed because there is complexity in the art of investment that is exacerbated by the complexity of human intervention.

The benefits of going to investment services to manage your investment are that they will consider your tendency or reluctance to risk.

They also work around the size of your capital assets and will help you meet your goals on time. For this, the investment manager will allocate your assets into a variety of products to have a balanced and eclectic portfolio. The right fund manager will also know how to allocate your fund so you can save the capital taxes obtained. And because divestment is part of investment, a fund manager will know the right time to liquidate your investment for maximum return or reinvestment.